Wedoany.com Report-Nov. 14, Spanish engineering and construction group ACS is reportedly close to forming a partnership valuing its digital infrastructure and energy business at approximately €23 billion ($26.8 billion), according to Spanish newspaper Expansion. Under the potential deal, Global Infrastructure Partners (GIP) would acquire a 50% stake in ACS’s newly established unit, called “Digital & Energy.”

The reported structure of the agreement includes around €5 billion in equity and €18 billion in debt financing. ACS had previously targeted a valuation of €3–5 billion for its data-centre business by 2030, meaning the potential deal exceeds earlier expectations. Neither ACS nor GIP, nor associated investor BlackRock, have publicly confirmed the details. ACS declined to comment, and GIP did not respond immediately to inquiries.

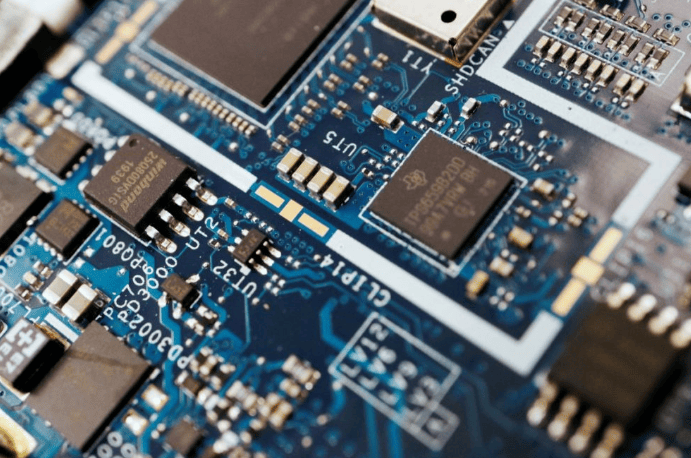

Investor interest in digital infrastructure, especially data centres, has surged due to rising demand from AI workloads and the increasing energy and land requirements of the sector. Analysts say the deal represents a substantial commitment to expanding data-centre capacity at scale.

For ACS, the partnership would be transformative. The Digital & Energy unit is active across multiple geographies and is expected to play a growing role in the company’s strategy. The inflow of both equity and debt capital from GIP would allow ACS to accelerate its development pipeline and expand capacity faster than could be achieved independently.

From the investor’s perspective, GIP gains exposure to the fast-growing digital infrastructure market while benefiting from ACS’s established development and construction expertise. The proposed joint structure allows both ACS and GIP to share operational risks as well as potential returns from large-scale data-centre projects. Analysts note that these infrastructure businesses are increasingly seen as “utility-like,” given the consistent demand and high barriers to entry.

Challenges remain, however. Building large-scale data centres requires significant capital investment and involves navigating planning, permitting, power supply, cooling, and connectivity requirements across multiple jurisdictions. Observers emphasize that execution and cost management will be critical to realizing the projected value. While the headline valuation is high, ultimate success will depend on achieving scale, securing tenants, and managing debt effectively.

ACS is expected to provide additional information on its strategy and the potential deal during an upcoming investor day later this week. The company may outline planned geographies, capacity targets, and timelines for the partnership, giving investors and stakeholders more clarity on the next steps for the Digital & Energy unit.

Overall, the proposed ACS–GIP partnership highlights the growing investor focus on digital infrastructure and positions both companies to benefit from the rapid expansion of data-centre networks to meet rising global demand.