Wedoany.com Report-Dec.25, SolGold Plc announced on Wednesday, December 24, 2025, that it has agreed to be acquired by its largest shareholder, Jiangxi Copper Company Limited, in an all-cash transaction valuing the company at 867 million pounds ($1.17 billion).

The offer provides 28 pence per share in cash, representing a 43% premium to SolGold’s closing share price on November 19, 2025, the day before Jiangxi Copper first approached the company with a proposal. This marks Jiangxi Copper's third attempt to acquire the London-listed miner, following earlier non-binding offers.

SolGold shares closed marginally higher at 25.65 pence in a holiday-shortened trading session on Wednesday.

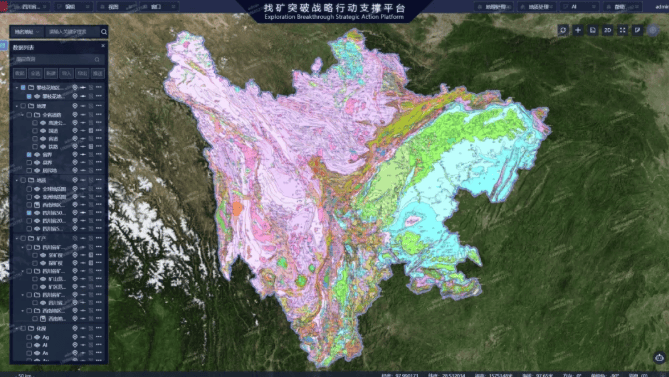

The agreement grants Jiangxi Copper control of SolGold’s flagship Cascabel copper-gold project, located in Ecuador’s Imbabura province. Cascabel is recognized as one of the world’s largest undeveloped copper-gold deposits in South America.

**Shaobing Zhou**, vice chairman and general manager of Jiangxi Copper, said: “JCC is delighted to have received the unanimous recommendation of the SolGold board and strong support from other large shareholders in favour of the acquisition. JCC is excited by the potential of the Cascabel project.”

The SolGold board has unanimously recommended the offer to shareholders. Major investors, including global miner BHP and Newmont, have provided support for the transaction. Jiangxi Copper already holds approximately 12.2% of SolGold’s issued share capital.

This acquisition aligns with industry efforts to secure copper resources amid growing demand from sectors such as electric vehicles and artificial intelligence infrastructure. Copper plays a vital role in these technologies, and projects like Cascabel offer significant long-term potential.

The deal is expected to proceed through a court-sanctioned scheme of arrangement under the UK Companies Act, with completion targeted for the first quarter of 2026, subject to shareholder and regulatory approvals.

SolGold, focused on exploration and development in Ecuador, has advanced Cascabel through detailed studies and planning. The project includes the Alpala and Tandayama-América deposits, positioning it as a key asset for future copper and gold production.

The transaction reflects strategic interest in high-quality copper-gold resources. Jiangxi Copper aims to leverage its technical expertise, financial capabilities, and supply chain strengths to advance the project.

This development underscores continued activity in the mining sector, where companies pursue opportunities to expand access to essential minerals for global energy and technology transitions.