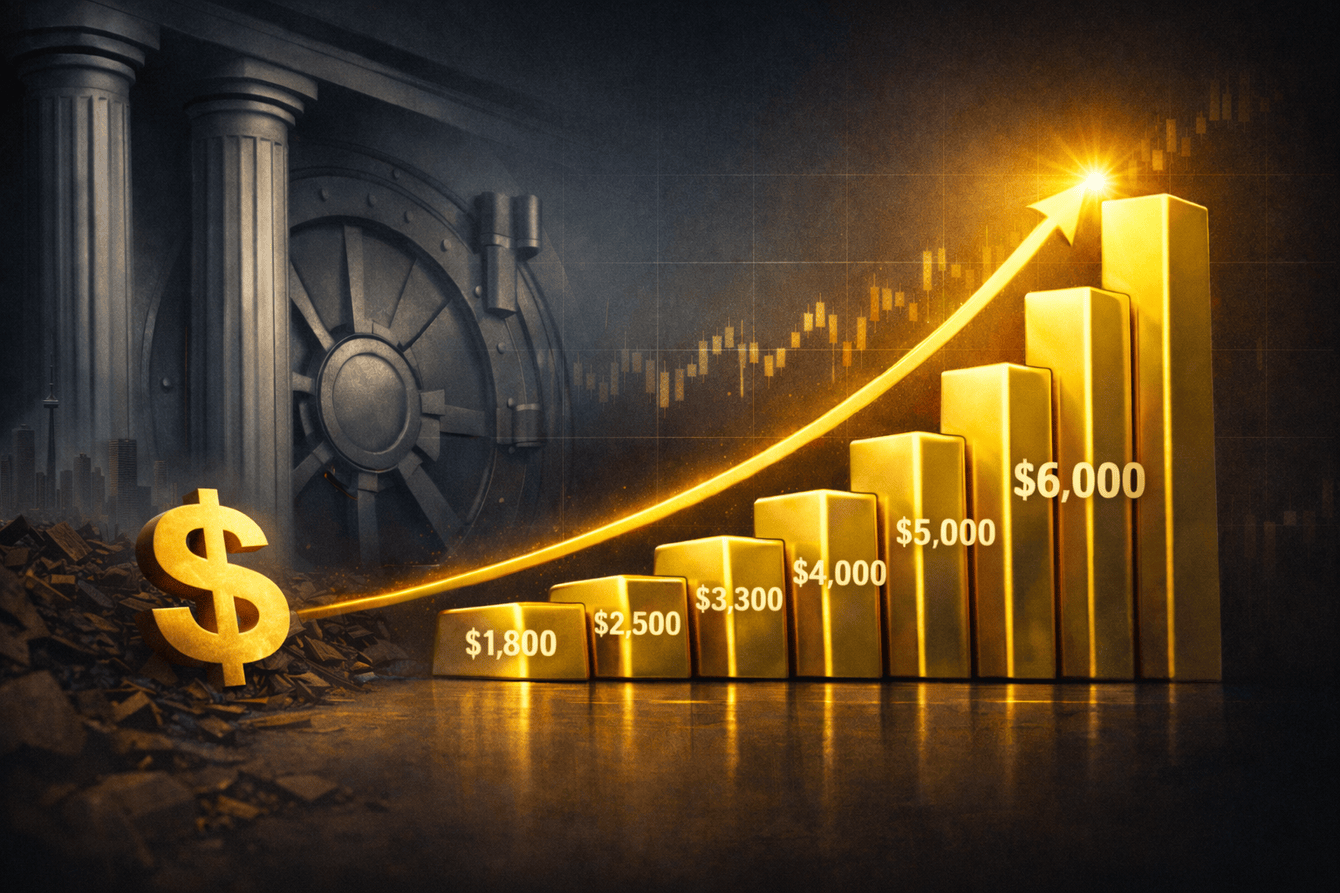

Wedoany.com Report on Feb 6th, CIBC (Canadian Imperial Bank of Commerce) has released its latest forecast, predicting that the average price of gold could reach $6,000 per ounce. This forecast is based on an ongoing assessment of global safe-haven demand.

The report notes that gold, as a traditional safe-haven asset, is influenced by various factors. CIBC analysts emphasize that market uncertainty may prompt investors to turn to gold, thereby supporting its price trend. The analysts stated, "Gold prices reflect investors' views on the economic outlook."

The recent performance of the gold market has drawn attention. Data shows that global gold demand remains stable, with some investors viewing gold as a significant component of asset allocation. Safe-haven demand has become one of the key factors driving gold prices.

The author of this article, Neils Christensen, holds a journalism diploma from Lethbridge College and has over a decade of reporting experience at Canadian news agencies. He has focused on financial reporting since 2007. Contact: 1 866 925 4826 ext. 1526, nchristensen@kitco.com, @Neils_c.

Disclaimer: The views expressed in this article are solely those of the author and may not reflect the position of Kitco Metals Inc. The author has endeavored to ensure the accuracy of the information, but neither Kitco Metals Inc. nor the author guarantees its completeness. This article is for informational purposes only and does not constitute any trading advice. Kitco Metals Inc. and the author shall not be liable for any losses incurred from the use of this information.