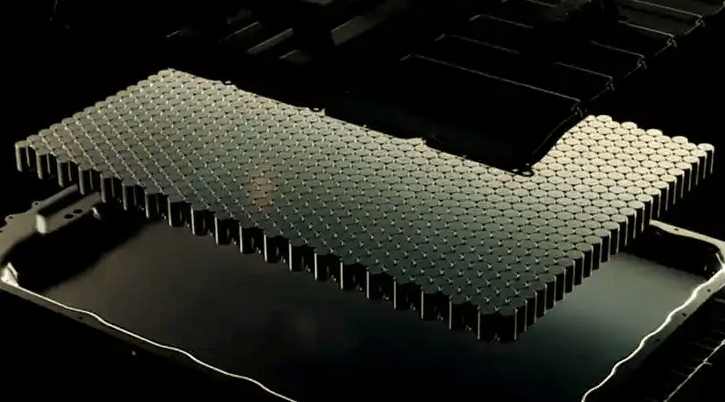

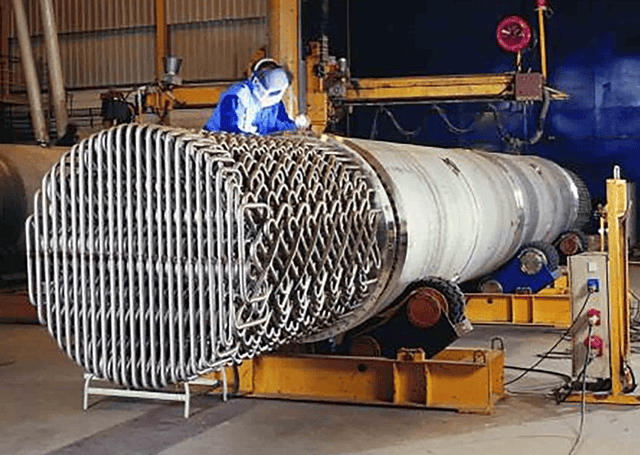

Wedoany.com Report on Feb 9th, Qixiang Tengda announced that the 8,000-ton/year high-performance catalytic new materials project, invested and constructed by its controlling subsidiary, Shandong Qilu Keli Chemical Research Institute Co., Ltd., has completed construction and officially entered the trial operation phase. The company stated it will accelerate equipment commissioning to strive for stable production as soon as possible.

The announcement pointed out that the commissioning of this high-performance catalytic new materials project will enhance the company's self-supply capability in the high-end catalytic materials field, consolidate the stability of the industrial chain, and strengthen its technological advantages. Meanwhile, leveraging the high value-added characteristics of the products and the industry background of accelerated import substitution, the project is expected to improve the company's long-term profitability and provide crucial catalytic material support for the chemical industry's transition towards green and low-carbon development.

In terms of financial performance, Qixiang Tengda released its 2025 annual performance forecast on January 26, expecting a net profit attributable to shareholders of the parent company to incur a loss of 470 million to 660 million yuan, compared to a profit of 31.6797 million yuan in the same period last year; the non-recurring net profit is expected to incur a loss of 478 million to 668 million yuan, compared to a profit of 12.5572 million yuan in the same period last year.

The main reasons for the performance change include: factors such as slowing global economic growth and domestic demand recovery falling short of expectations have overlapped, causing the chemical product market to be in a cyclical trough, resulting in the company's performance showing a pattern of high in the first half and low in the second half. Facing market challenges, the company has implemented measures such as cost reduction and efficiency enhancement, optimization of existing assets, and lean management. It has reduced energy consumption through technological upgrades and improved efficiency by optimizing production scheduling; strengthened market analysis, flexibly adjusted product structure and sales strategies, and expanded into high value-added niche markets; enhanced bargaining power in the supply chain, partially alleviating raw material cost pressures; and strictly controlled various expense outlays.

Furthermore, the company's financing costs continued to decline during the reporting period. The average financing cost in 2025 decreased by 0.49 percentage points compared to the same period last year, significantly reducing financing expenses. Simultaneously, leveraging its regional advantages in overseas trade and its long-established sales network, the company actively explored the international market. During the reporting period, export products reached 650,000 tons, a year-on-year increase of 12.12%, reaching a record high. This effectively alleviated domestic sales pressure and laid the foundation for expanding into emerging markets.