Wedoany.com Report-Feb 27, BP, the London-based oil giant, has revealed a major shift in its energy strategy, reducing its annual budget for energy transition projects by over 70%, dropping from $5 billion to between $1.5 billion and $2 billion. This adjustment scales back spending on renewable initiatives while redirecting focus toward fossil fuels. However, the company is maintaining selective investments in hydrogen and carbon capture technologies as part of its revised plan.

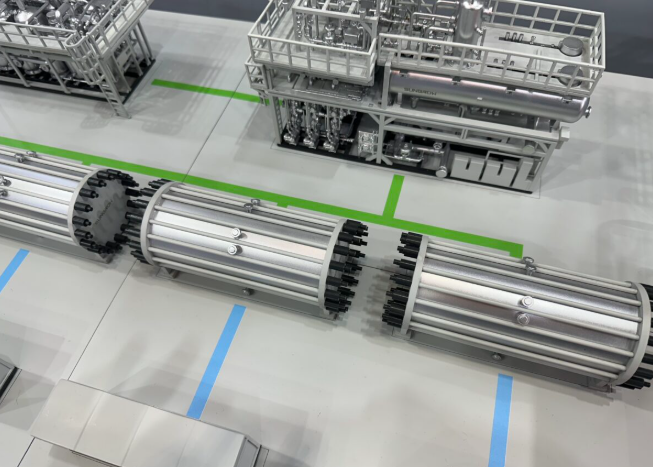

The strategy overhaul reflects BP’s effort to balance growth and sustainability amid global economic challenges. The company continues to target net-zero emissions across its products by 2050, upholding its long-term environmental commitment. Key projects, such as the 100MW Lingen green hydrogen plant in Germany, remain on track following its final investment approval in December. Set to support BP’s refining operations, this facility highlights the company’s focus on low-carbon solutions. Plans for a 1.2GW blue hydrogen project in northeast England are also advancing, integrating carbon capture and storage to minimize emissions.

This shift mirrors actions by other energy firms like Shell and Equinor, which are reassessing their strategies due to financial pressures and investor demands for profitability. BP’s decision follows a period marked by global disruptions, including the COVID-19 pandemic, the conflict in Ukraine, and economic downturns, which have reshaped market dynamics and government policies on energy transition.

During an investor meeting in London, BP CEO Murray Auchincloss addressed the change, saying: “In 2020 we made some bold strategic changes, accelerating into the energy transition while progressively reducing our hydrocarbon business. However, our optimism for a fast [energy] transition was misplaced, and we went too far, too fast.” He explained that the updated approach prioritizes reallocating funds to high-return areas, boosting efficiency, and enhancing cash flow and returns sustainably.

Though funding for broader green energy efforts has decreased sharply, BP’s continued investment in hydrogen underscores its view of the technology as a key component of the future energy mix. The Lingen and northeast England projects demonstrate a targeted approach to low-carbon innovation, aligning with industry trends toward practical, high-impact sustainable solutions. This selective focus aims to ensure BP remains competitive while adapting to evolving global energy demands.

The company’s strategy reset does not abandon its environmental goals but adjusts the pace and scope of its transition efforts. By concentrating on hydrogen and carbon capture, BP seeks to maintain progress in critical areas while strengthening its core fossil fuel operations to navigate current economic realities. This pragmatic shift highlights the complex interplay between profitability, investor expectations, and long-term sustainability in the energy sector.