Wedoany.com Report-Sept. 26, Aclara Resources, a Canadian rare earths company listed in Toronto, has announced a $1.3 billion investment to develop rare earth mines in South America and processing facilities in the United States. The announcement was made by Executive Vice President Jose Augusto Palma during a recent mining industry conference.

REEs are a group of 17 metals with distinctive magnetic, optical and conductive properties.

The investment plan includes $150 million to $170 million for a mining project in Chile and approximately $600 million for a mine in Brazil. Additionally, Aclara will allocate $300 million to $400 million to construct a separation plant and $400 million for a metallization facility. These facilities aim to process rare earth elements (REEs), which are essential for technologies such as electric vehicle motors, wind turbines, robotics, and advanced defense systems due to their unique magnetic, optical, and conductive properties.

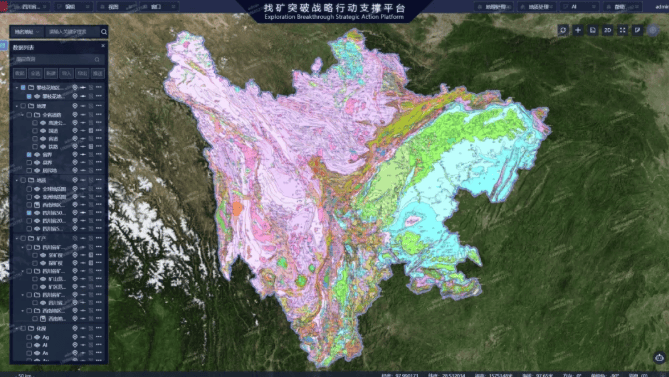

Feasibility studies for the projects in Brazil and Chile are on track for completion by mid-2026, according to Palma. This timeline sets the stage for construction to begin in 2026, with operations expected to start by 2028. In support of these efforts, the US International Development Finance Corporation recently committed up to $5 million to fund the feasibility study for the Brazil project, highlighting the strategic importance of the initiative.

Aclara’s strategy focuses on creating an independent supply chain for permanent magnets, addressing the growing global demand for REEs in consumer electronics and renewable energy technologies. In April, the company opened a semi-industrial heavy rare earths pilot plant in Aparecida de Goiânia, Goiás, Brazil, marking a key step in testing and refining its production processes.

“We are deeply honored to have been selected by the US DFC as a recipient of the project development funds,” said Aclara CEO Ramón Barúa. “This initial investment is not only a validation of Aclara’s strategy, but also an important first step toward a larger commitment from DFC once we complete the feasibility study for the Carina project.”

In July, Aclara also revealed ongoing discussions with US government agencies to explore additional financing for its broader $1.5 billion plan to develop rare earth resources in Latin America. These efforts reflect the company’s commitment to advancing sustainable and efficient rare earth production, positioning it as a key player in the global supply chain for critical minerals.