Wedoany.com Report-Nov. 18, Viridis Mining and Minerals, an Australian company, announced on Tuesday that it has received a non-binding letter of interest from Export Development Canada (EDC) for potential debt financing of up to US$100 million. The funds would support the development of its Colossus rare earths project located in Minas Gerais, Brazil.

This expression of interest from Canada’s export credit agency follows a similar letter of support previously issued by France’s Bpifrance Assurance Export. Both are intended to facilitate the project’s transition into the execution phase, the company stated.

Rafael Moreno, Managing Director of Viridis, commented: “Endorsement from one of the world’s most respected export credit agencies has the potential to strengthen the project’s role in diversifying and securing Western rare earth supply chains.”

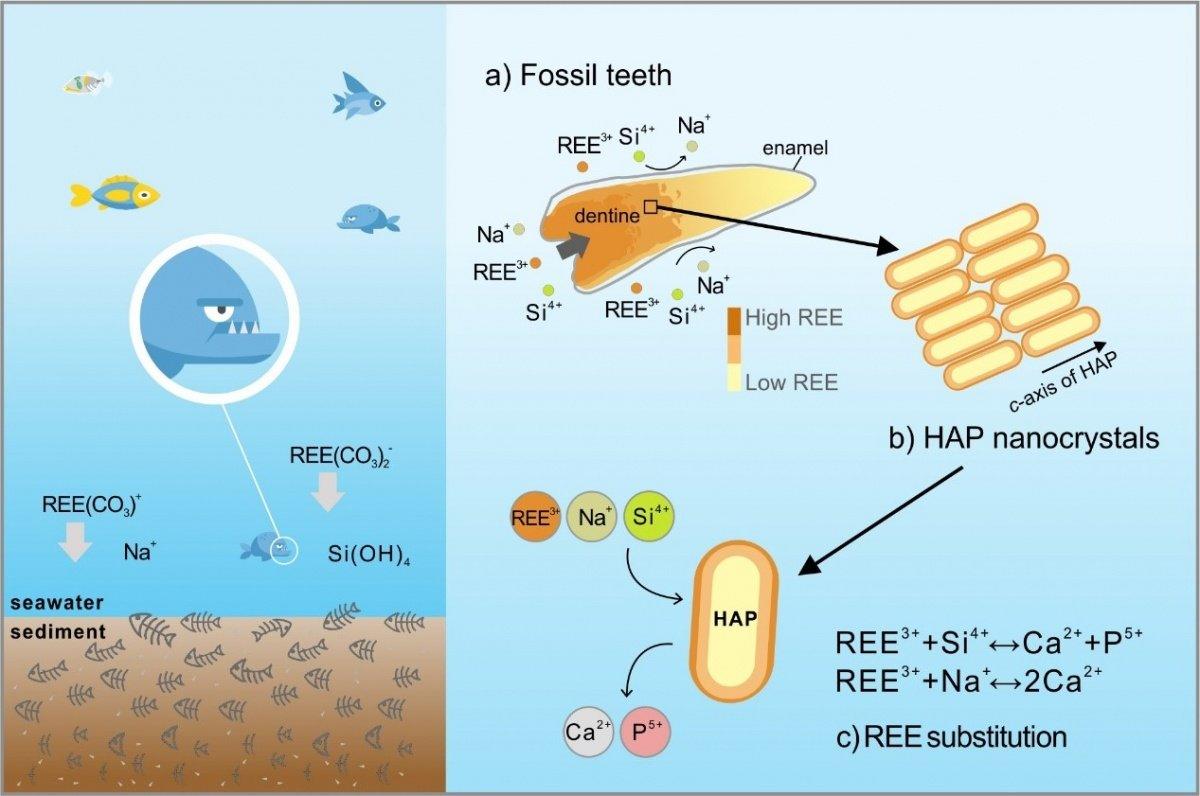

The Colossus project hosts Ionic Adsorption Clay deposits, a geological formation in which rare earth elements are loosely attached to clay minerals, allowing comparatively straightforward and lower-cost extraction processes.

Interest from the Canadian agency reflects broader efforts by several Western countries, including Canada, Australia, France, and the United States, to support the establishment of rare earth supply chains independent of the current dominant producer.

Viridis indicated that it will continue detailed financing discussions with EDC and other partners in the coming months as the project moves toward full funding arrangements.

The company emphasized that any final financing remains subject to EDC’s completion of standard due diligence, internal approval processes, and typical project finance conditions.

The Colossus project is advancing through feasibility and permitting stages, with the potential backing from export credit agencies expected to enhance its access to international capital markets.