BHP and Lundin Mining's Vicuña joint venture project on the Argentina-Chile border has a post-tax net present value of $95 billion, according to a new study. This 70-year copper-gold-silver project, with production expected to begin in 2030, ranks among the top global development projects in terms of both value and output.

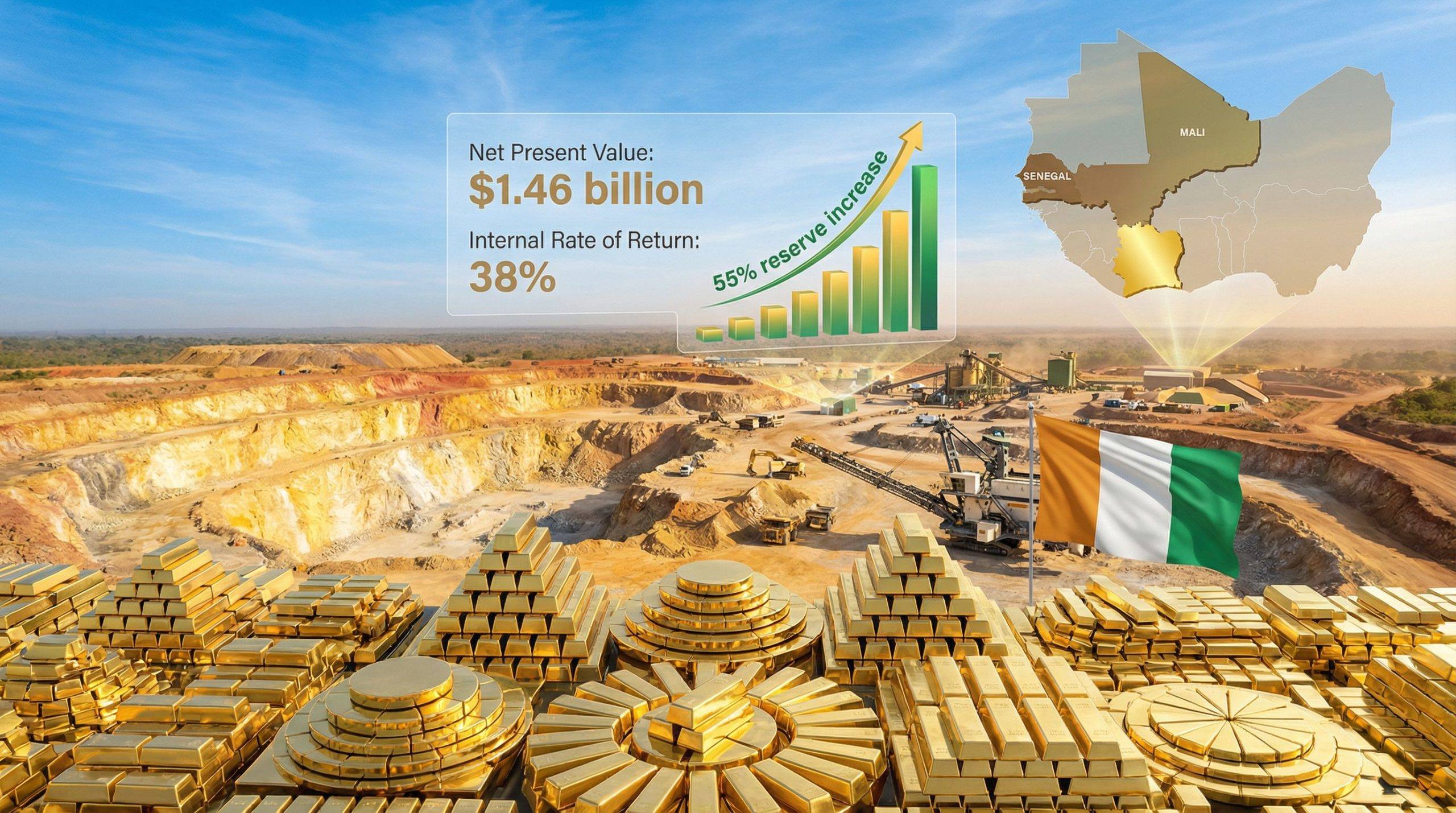

A preliminary economic assessment indicates that, under specific price assumptions, the Vicuña project has an internal rate of return of approximately 15%. Its net present value is second only to the Kamoa-Kakula expansion project in the Democratic Republic of the Congo but higher than the Cascabel project in Ecuador. Vicuña is located about 700 kilometers northeast of Santiago.

BMO Capital Markets analyst Matthew Murphy described Vicuña as a "clear tier-one asset," notable for its large scale and long lifespan. He stated, "During peak production, the mine could yield over 500,000 tonnes of copper, 800,000 ounces of gold, and 20 million ounces of silver annually for a decade."

Murphy added in the report, "We expect subsequent phases to be self-funding under BMO's pricing." The PEA estimates an internal rate of return of 25.5% at spot prices, with a payback period of only 5.4 years. Lundin Mining CEO Jack Lundin noted, "The study outlines a project that would rank among the world's top five mines for copper, gold, and silver." He mentioned that phased development would help manage risks and increase output.

Located in a region near the Chilean border, the Vicuña project aims to meet global copper demand, a critical metal for electrification and the green energy transition. The project integrates the Josemaria and Filo del Sol deposits, which are 10 kilometers apart, and is being developed from a regional perspective.

The project is expected to produce 400,000 tonnes of copper, 700,000 ounces of gold, and 22 million ounces of silver annually over the first 25 years. Total production is projected to be 22.3 million tonnes of copper, 37.2 million ounces of gold, and 763 million ounces of silver, ranking it second globally in terms of output.

The capital expenditure for the Vicuña project is estimated at $181 billion, with sustaining capital of $303 billion, including closure costs, making it one of the most expensive mining projects in the world. A resource update shows increased reserves of copper, gold, and silver in the proven and probable categories.