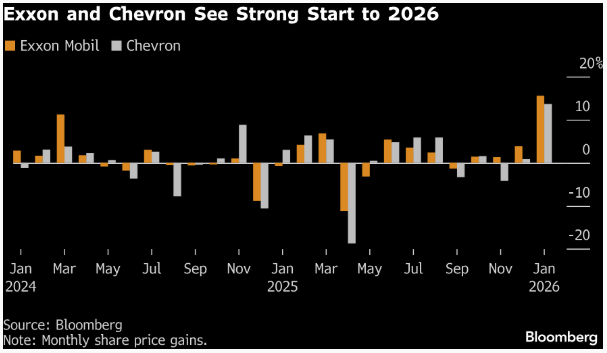

Wedoany.com Report on Feb 2nd, Driven by climbing energy prices and improving industry fundamentals, the stock prices of U.S. oil giants ExxonMobil and Chevron have shown strong performance recently and are on track for their biggest monthly gains in over three years. ExxonMobil rose 15% in January, while Chevron is poised for a 14% gain. If maintained until Friday's close, this would mark the best monthly performance for both companies since October 2022.

Accompanied by rising oil prices and a generally stronger market, the energy sector has been the top-performing area of the S&P 500 index year-to-date. Both companies reported fourth-quarter earnings that exceeded analyst expectations, with higher oil production partially offsetting the impact of falling crude prices late last year. Chevron's increased production in Kazakhstan and Guyana contributed to earnings per share growth, while ExxonMobil also demonstrated strength in production, although its chemical business margins weakened.

Energy stocks have had a strong start to 2026, largely due to the recent rapid rise in oil prices. Brent crude futures are approaching their highest levels since last July, linked to U.S. policy adjustments regarding Venezuela and escalating tensions concerning Iran. Although concerns about oversupply weighed on the sector's performance last year, some analysts expect the supply outlook to improve in the coming months. Allen Good, Director of Equity Research at Morningstar, noted: "Improving producer profits and cash flows have strengthened company financials, allowing their performance to outpace the crude price itself. Combined with factors like relatively low ownership levels and attractive valuations, energy stocks are justified in the current environment."

Market technical analysis indicates that energy-focused exchange-traded funds are nearing a breakout from a four-year trading range, yet investor allocation to the sector is not excessive. Jonathan Krinsky, Chief Market Technician at BTIG LLC, believes: "Industry attention remains relatively limited, and this relative strength could persist into spring."

Regarding the operational prospects for U.S. energy companies in Venezuela, ExxonMobil CEO Darren Woods emphasized the need for a secure legal and safety environment before investing, but he expressed confidence that the U.S. government is committed to stabilizing the situation there. Morningstar's Good commented: "Venezuela is more of a market talking point at the moment." Jason Gabelman, Managing Director of Energy Equity Research at TD Cowen, pointed out that strengthened industry fundamentals have made energy stocks more resilient to oil price fluctuations: "Optimized corporate cost structures and enhanced capital discipline make them more resilient in lower commodity price environments."